Insurance depends on time and trust: even a 24-hour delay in claims can drive clients away. Rising expectations and cost pressure mean people now want service in seconds. Chatbots solve this by processing claims, answering questions, and handling policy changes 24/7. IBM notes many insurers already use them, with automation taking on more transactions.

The market is growing fast: by 2030, chatbots could save over $8B annually. Beyond efficiency, they help retain customers in a loyalty-sensitive industry.

What is a chatbot for insurance agencies?

A chatbot is a program that uses pre-written rules or artificial intelligence to simulate conversation. In the context of insurance it performs tasks that would otherwise require a call center agent.

The simplest type of chatbot follows fixed rules. For example it can answer a question about office hours or provide a copy of a policy document. More advanced systems rely on natural language processing to understand complex queries. They analyze the intent behind customer questions and provide more relevant answers.

In practical terms a chatbot can help a client file a claim, check the deductible, or request an update on payment status. Each action is recorded in the system which saves time for both staff and customers.

Forbes Advisor reports that companies that use chatbots see higher efficiency in routine tasks and better feedback from clients.

Key benefits of using chatbots in insurance

Insurance agencies that adopt chatbots benefit in several ways. These benefits appear both in daily operations and in long term strategy.

- Chatbots give 24/7 customer support which builds loyalty.

- They reduce the time needed for claims processing.

- They lower operating costs by reducing call center workload.

- They offer personalized experiences using customer data.

24/7 customer support

Customers expect service whenever they need it. If a policyholder in California faces an issue at 2 am they do not want to wait until the office opens. A chatbot can respond instantly with the right guidance.

This does not mean that human staff become irrelevant. Instead they can focus on more complex situations that require empathy and judgment. By filtering routine questions, chatbots reduce average wait time and increase customer satisfaction.

Streamlined claims processing

Submitting and tracking claims is traditionally one of the most stressful experiences in insurance. Forms are complex and the process is often slow.

Chatbots can simplify this by guiding the customer through each step. They collect the required information, verify basic details, and upload supporting documents. Customers can then track progress in real time.

According to Chatbot.com, this reduces manual errors and allows faster payouts. Insurers also save money by cutting administrative work.

Personalized customer interactions

Modern chatbots do more than answer basic questions. They analyze policyholder data to provide customized recommendations. A client with a growing family might receive a reminder about additional health coverage. A small business owner could be guided toward a more suitable liability plan.

This personalization increases engagement and revenue. It also creates a sense of partnership between the insurer and the client rather than a purely transactional relationship.

Real world examples of chatbots in insurance

Several well known companies have already adopted chatbots successfully. Their experience shows both the opportunities and the limitations of this technology.

- Lemonade uses its AI system called AI Jim to approve simple claims in seconds.

- Geico has a virtual assistant that handles quotes, billing, and policy management.

- Allstate created ABIE to help small business customers navigate complex coverage questions.

These examples demonstrate that chatbots work for both consumer and business insurance.

How Lemonade uses chatbots for claims

Lemonade has disrupted the traditional insurance model by making claims processing fast and transparent. Its AI Jim chatbot can verify and approve many claims in less than 90 seconds.

This speed is possible because the chatbot cross checks policy details, fraud indicators, and claim data automatically. Only cases with unusual patterns are escalated to human staff. For customers this creates an experience that feels instant and reliable.

Geico’s virtual assistant for policy management

Geico’s virtual assistant offers a wide set of functions. Customers can check balances, update coverage, or get new quotes without speaking to an agent.

The assistant is available through mobile apps and web platforms. It reduces the burden on call centers and ensures that routine tasks are resolved immediately.

This approach has made Geico one of the leaders in digital insurance services.

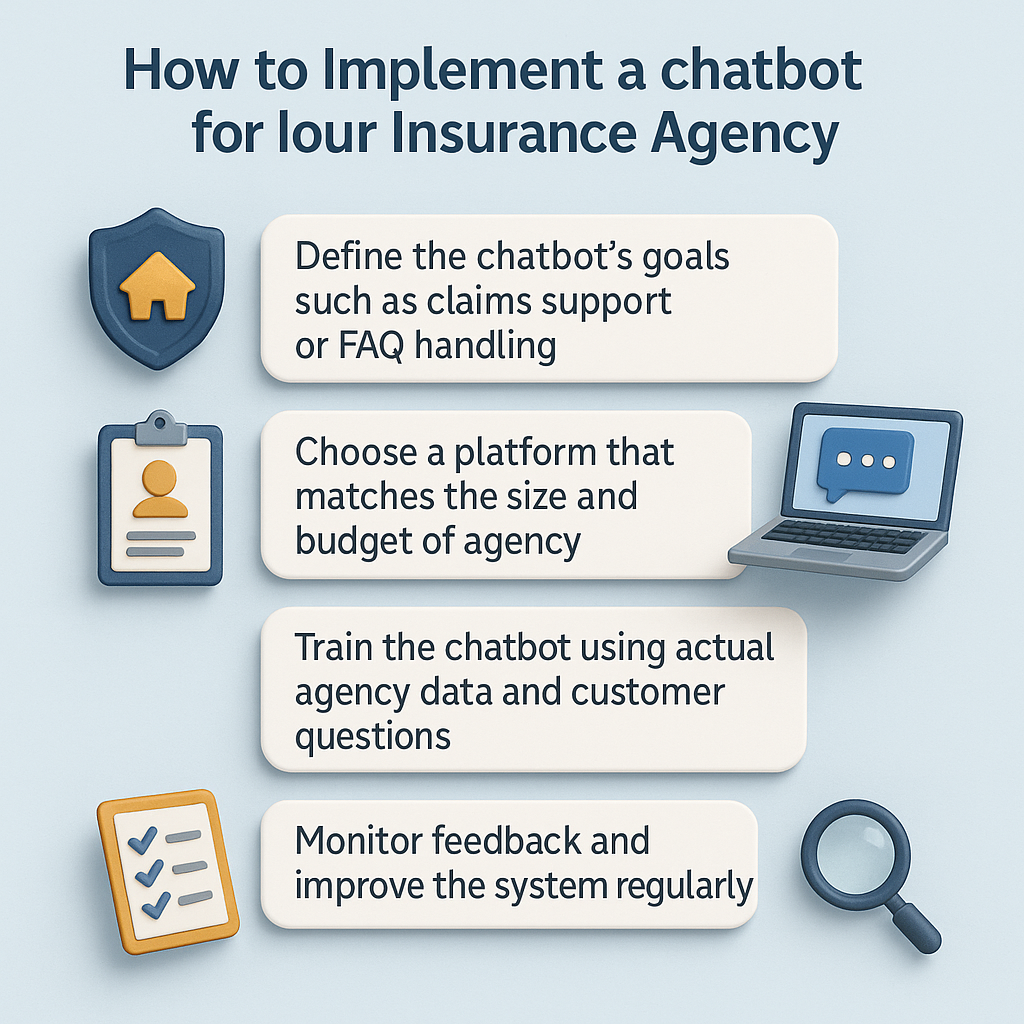

How to implement a chatbot for your insurance agency

Implementation requires careful planning. Rushing a chatbot into production without preparation can damage trust. Agencies should follow a structured approach.

- Define the goals of the chatbot such as claims support or FAQ handling.

- Choose a platform that matches the size and budget of the agency. Options include Dialogflow, IBM Watson, or Microsoft Bot Framework.

- Train the chatbot using actual agency data and customer questions.

- Test the system with a small group before wider release.

- Monitor feedback and improve the system regularly.

Many agencies now combine text chat with voice interfaces. Integrating APIs such as the Graphlogic Text-to-Speech API can improve accessibility for clients who prefer phone interactions.

Choosing the right platform

Platforms differ in features and complexity. Dialogflow offers an easier setup and is popular with smaller agencies. IBM Watson is more advanced in analytics and suits larger organizations. Microsoft Bot Framework integrates well with enterprise systems.

The decision should be based on integration needs and available technical support. The wrong choice can increase costs and delay deployment.

Training your chatbot for insurance specific tasks

Training is one of the most critical steps. A chatbot that does not understand insurance terminology will frustrate customers. It must be trained with actual policies, FAQs, and workflow details.

Updates are necessary as new products and regulations appear. Agencies that fail to update risk inaccurate responses.

Solutions like the Graphlogic Generative AI & Conversational Platform allow agencies to expand training faster and adapt to new requirements.

Challenges of using chatbots in insurance

Chatbots bring efficiency but they also introduce risks that insurance agencies cannot ignore. The technology is powerful, yet it must be applied carefully.

One of the most common challenges is handling complex or emotional situations. When a customer reports a serious accident or a health emergency, they expect empathy and reassurance. A chatbot cannot yet provide the same level of emotional intelligence as a trained human agent. This creates a risk of alienating clients during sensitive moments. Agencies must design systems that hand off such cases quickly to human staff.

Another concern is data privacy and security. Insurance involves highly sensitive personal and financial information. Any breach can lead not only to regulatory fines but also to loss of trust. Chatbots must comply with strict rules about data handling, storage, and encryption. Agencies need to ensure that interactions are logged securely and that data sharing is minimized. HealthIT.gov emphasizes that compliance with privacy standards is non negotiable when dealing with health or personal data.

Customer frustration is also a real risk. If the chatbot cannot recognize the query or fails to connect the user with a live agent, the experience can damage the relationship. Poorly designed escalation processes are a frequent cause of negative feedback. Agencies should always allow customers to reach a human within a reasonable time frame.

Regulatory oversight adds another layer of complexity. Governments and regulators closely monitor how insurance companies use AI and automation. Agencies must document how their chatbots make decisions and provide clear explanations when customers ask for them. This transparency is essential to maintain both compliance and trust.

Finally, there is the challenge of ongoing maintenance. A chatbot is not a one time project. It requires constant updates to reflect new policies, products, and regulations. Without regular updates the system risks becoming outdated and inaccurate, which can increase legal exposure.

Trends and forecasts in chatbot adoption

The adoption of chatbots in insurance is not static. It is evolving rapidly as technology advances and customer behavior changes. Several trends are shaping how chatbots will be used in the coming years.

- Voice assistants are expanding at a fast pace. Improvements in speech recognition mean that customers can interact naturally with systems instead of typing messages. This makes chatbot interactions more inclusive for elderly clients or those with disabilities. It also mirrors the growing popularity of smart speakers and voice controlled devices.

- Predictive analytics is another major trend. By analyzing patterns in customer data, chatbots will soon be able to anticipate problems before they arise. For example, they could suggest policy adjustments before a renewal period based on lifestyle changes detected in the data. This turns the chatbot from a reactive tool into a proactive advisor.

- Integration with Internet of Things devices is already starting. Connected cars, smart home sensors, and wearable health trackers can feed real time data to insurers. A chatbot connected to these devices can provide instant advice, adjust premiums dynamically, or trigger preventive alerts. This capability will redefine how insurers manage risk and interact with customers.

- Multilingual chatbots are also becoming essential. In markets with diverse populations, insurers cannot rely on English only services. AI systems now support dozens of languages, making customer support more inclusive and competitive. The ability to serve clients in their native language will be a key differentiator.

- Hybrid models that combine AI with human support are emerging as the most effective approach. These systems let chatbots handle repetitive tasks but ensure that a human is available when empathy or complex judgment is required. This balance improves both efficiency and satisfaction.

Looking forward to 2030, most routine insurance interactions are likely to be handled by AI. Customers will use chatbots for renewals, claims, and policy updates as the default. Human agents will still play a critical role, but their focus will shift to high value interactions such as negotiating complex claims or offering financial advice. Agencies that adapt early will be better positioned to compete in a digital first market.

Key takeaways about chatbots for insurance agencies

- Chatbots give instant and continuous service that customers now expect.

- They streamline claims, reduce costs, and improve engagement.

- Real examples from Lemonade, Geico, and Allstate prove the value of automation.

- Successful deployment requires careful planning, the right platform, and regular updates.

- Future developments will make chatbots even more predictive and human lik

FAQ

It is a software program that interacts with customers to answer questions, process claims, and manage policies.

They provide instant answers, reduce wait times, and are available 24/7.

Lemonade uses AI Jim for claims, Geico has a virtual assistant, and Allstate developed ABIE.

Start with clear goals, select the right platform, train it with insurance data, and test it with a small group before expansion.

They may not handle complex queries well, data privacy must be ensured, and customers still expect human escalation when needed.